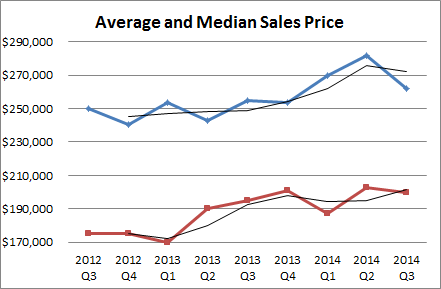

Third quarter Big Bear real estate numbers are showing mild price declines over the previous quarter while still showing gains as compared to the third quarter of 2013.

Compared to the second quarter of this year, the third quarter saw a 7% drop in the average sale price down to $261,892 and a 3% drop in the average price per square foot down to $185.

But compared to third quarter sales a year ago, we are still seeing across the board gains in home prices. The average and median sales prices are up 3% while the average and median price per square foot are up 8% and 13% respectively.

The DOM (Days On Market) has dipped slightly this year dropping from 92 days to 84 days while the average sales price/list price has stayed steady at 97%.

The big difference we see in the real estate data are in the number of sales. Third quarter sales were down 15% from last year's closings. If buyer demand drops, prices gains generally slow, stabilize, or in the worst case, decline.

But with interest rates dipping near historical lows this past week, and with the recent purchase of our ski resorts by Mammoth Mountain based developers, as a worst case scenario, I would think our real estate market will simply see slower price appreciation moving forward than the double digit price gains we've seen over the past few years.

With the 30 year fixed mortgage rate currently below 4%, and with the prospect of major developers taking Big Bear's resort community to the next level, I am optimistic that Big Bear will remain not only a great place to buy a second home as an investment, but also a world class getaway in which to enjoy a mountain lifestyle.