Real estate sales in Big Bear dropped precipitously this November with only 56 closings compared to 164 last November. But there are reasons this drop occurred. The first reason was the forest fire we had in September which closed the valley to visitors. The second reason was the pending November vote on Measure O which would limit vacation rentals.

With fewer buyers in Big Bear due to the fire and with many buyers choosing to await the outcome of the Measure O vote before buying (it did NOT pass and vacation rentals are continuing to operate as usual), and being that a typical escrow period is about 45 days, it makes since that November's Big Bear home sales would be substantially lower.

That being said, here are the sales numbers comparing November 2021 Big Bear home sales to those of November 2022.

The number of Big Bear homes sold dropped from 164 to 56 representing a decline of about 66%.

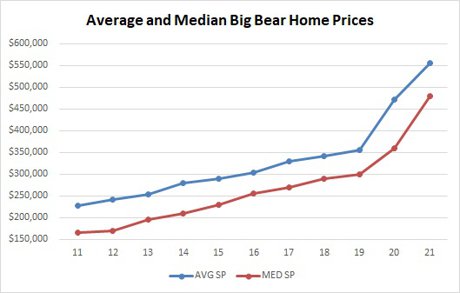

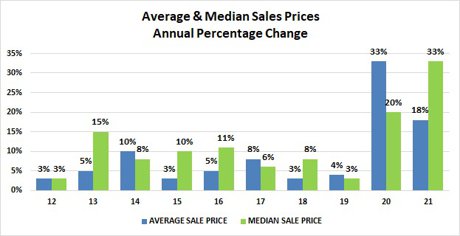

The Average sale price dropped from $571,654 to $522,588 representing a drop of about 9%.

The median sale price dropped from $500,000 to $415,000 representing a drop of about 17%.

The average sales price to list price ratio dropped from 101% to 98%.

The average number of days a Big Bear home was listed before selling rose from 58 days to 82 days.

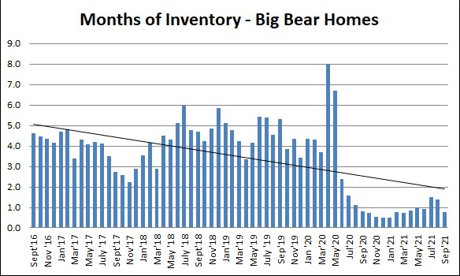

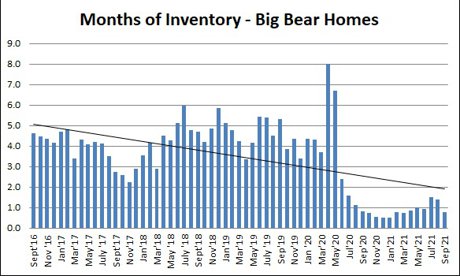

There were 56 homes listed for sale in the Big Bear MLS around this time last year. Currently there are 237. That is an increase in home inventory of about 400%! But if you compare the current 237 listings to the 402 listings we had in December 2019, our most recent pre-covid year, home inventory is still lower than what one would expect in a normal market.

Interest rates have actually started simmering down dropping to an average 6.33% for a 30 year fixed compared to their height a few weeks ago at %7.08. But rates are still 3.22% higher than at this time last year.

Looking forward to writing my YEAR IN REVIEW summary in just a few weeks. Until then, HAPPY HOLIDAYS!