I oftentimes get my ideas for blog posts by overhearing statements made about the Big Bear real estate market that I am not quite sure are fact-based. In this regard, today's post was compliments of a conversation I heard about cash sales.

In this conversation, the following claims were made:

1) Cash sales are rare. Fewer than 10% of Big Bear homes are purchased with cash.

2) Buying a home with cash allows you to purchase the home for far less than you could than if you had purchased with a loan.

3) Most people who buy with cash are affluent, so it's usually the higher-end homes that sell for cash.

All three of these seemed like reasonable assertions. But I turned to the Big Bear MLS to test these claims.

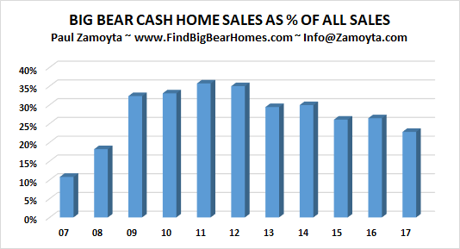

Take a look at the figure below showing the number of cash sales over the past 11 years.

Back in 2007, you see very few homes purchased with cash. This was at the height of the record real estate boom when just about anyone could qualify for a home loan. As the real estate market collapsed, loans became more difficult to qualify for and cash sales increase not only in number, but also grew as a percentage of all Big Bear home sales.

But our first claim was that cash sales made up less than 10% of all sales. Take a look below.

At Big Bear real estate's lowest point, only 10% of all sales were cash. This was at the market's height when prices topped out. Conversely, cash sales as a percent of all sales peaked in 2011 at the bottom of the market. Savvy investors who were sitting on cash took advantage of the 50% drop in Big Bear home values resulting in cash sales making up 35% of all sales. As the market recovered, cash sales have settled back down to about 20%-25% of all sales.

So our first claim was debunked.

Let's look at the second claim; that purchasing with cash allows you to pick up a Big Bear property at a discount price.

I ran the numbers on Big Bear home sales going back to 2011 and found that the average sales price to list price ratio for cash purchases was 95.87% while the ratio for non-cash purchases was 97.26%. This suggests that cash purchasers have a 1.39% advantage in negotiations. Based on the average sale price of Big Bear homes from the last quarter of $356,000, this results in about a $5000 advantage for cash buyers.

Is $5000 a major discount on a $365,000 purchase? Some might say that $5000 is significant while others will say that getting a 1.39% return on your cash investment is ridiculously low.

I will leave judging the legitimacy of this claim up to you.

Lastly, there was the claim that only affluent people purchase with cash, therefore most cash sales are in higher-end, luxury homes.

Once again, looking at the numbers going back to 2011, the average sale price of homes purchased with cash was $263,639 compared to $271,504 for non-cash sales. Being that these sales prices are so similar (less than 3% apart), this suggests that cash sales do not occur predominantly in the higher price ranges, but are more likely are distributed throughout all price ranges.

So claim three is debunked as well.

To me, the interesting takeaway in looking at cash sales is how they may give valuable insight into the Big Bear real estate market.

Cash sales were lowest in 2007 when prices were highest and buyers had ridiculously easy access to mortgages. This set up the market collapse in 2008. So a low number of cash sales may signal a market high-point.

Cash sales were highest when the market bottomed in 2011 and prices were at their lowest. So a high number of cash sales may signal a market turnaround.

In the last few years, we've seen qualifying for loans become much easier. In fact, we are starting to see stated loans and "hard money loans" creep back into the market. Although we are far from the free-flowing credit of the mid-2000s, the lending market definitely seems to be moving in that direction. It will be interesting to see how cash sales evolve over the next few years and if they may help us predict which way the Big Bear real estate market is headed.

Paul Zamoyta ~ Info@Zamoyta.com ~ 909.557.8285