Having already reported on the overall Big Bear Real Estate market's performance for 2015, I wanted to take a specific look at lakefront home sales as they have become a focus of my business over the past decade.

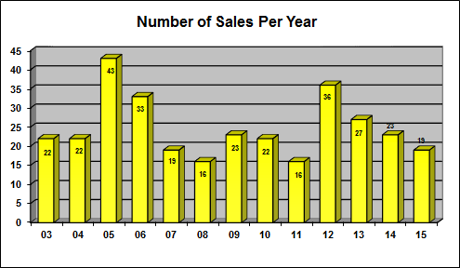

Let's start by looking at a history of the number of Big Bear lakefront homes sold.

You can see that over the past few years, the number of sold Big Bear lakefronts has declined annually. I would attribute this to two things: the cooling off from the unexpectedly strong market rebound in 2012 and the decline in the lake's water levels over that time.

To see the dramatic effect that the lake's water level can have on real estate sales, note that the lowest that Big Bear Lake has been in over 35 years was when it was down about 17 feet in 2004. After a winter of above average precipitation, the lake was nearly full by the following spring of 2005. You can see that sales almost doubled as a result.

We have had a few good snow storms already this year but not nearly enough to seriously impact our low lake levels. The good news is that there is plenty of winter left to come and we will almost certainly see more precipitation. Hopefully it will be significant and our Big Bear lakefront home sales will jump as they did in 2005.

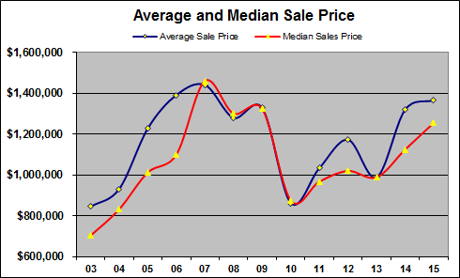

Next, let's take a look at Big Bear lakefront home prices.

You can see that lakefront home prices are continuing to climb back to their heights in 2006/2007. The median is about 15% off the market high while the average is about 5% short of it's 2007 peak. In relation, the overall real estate market is still about 30% off their all-time highs. So lakefront values have rebounded faster than the overall market, once again suggesting that the Big Bear lakefront market outperforms the overall Big Bear real estate market.

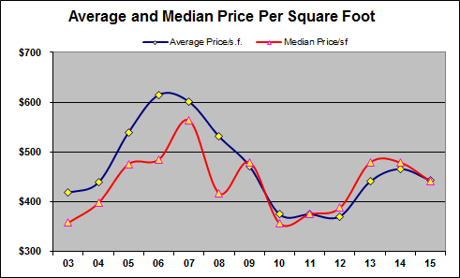

We see the same in the price per square foot numbers for lakefronts.

Although the price per square foot of Big Bear lakefronts appears to not have risen as strongly as the overall sales prices, the median is down 20% and the average about 30% which is still better than the overall market.

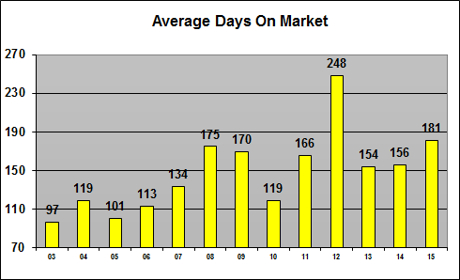

As far as how quickly Big Bear lakefront homes sold in 2015, note the following.

The rise in the days on market can be somewhat deceiving (as all numbers can be). At first glance, one would think that with it taking longer on average for a Big Bear lakefront home to sell, that the buyers might be gaining an edge in the market.

But not unlike 2012, a higher days on market might mean the opposite. It might be that homes that have been on the market for a really long time are finally selling. This suggests that the market has caught up to these lakefront sellers who originally overpriced their properties. If you look at it that way, the rise in days on market is a good thing. I will post a future blog post looking into this in more detail.

Now let's look at the sales price to list price ratio.

This graph shows two things. The blue line shows the average percentage of the list price at the time of sale that lakefronts sold for in that given year. The red line shows the average percentage of the original list price that lakefronts sold for in that given year.

You can see that although lakefronts sold at about 94% of their list price at the time of sale, you'll see that they also sold for about 89% of their original list price. This suggest that on average a lakefront seller will drop their list price about 7% before selling for about 4% lower than that. The good news in looking at this graph is that the gap between the original list price and the eventual sales price has closed compared to 2011-2012.

In summary, although sales were down in 2015, prices remained solid and the Big Bear lakefront real estate market has remained relatively resilient to Big Bear Lake's lower water levels. If we get late season El Nino moisture as predicted, I would expect us to see sales jump in 2016. Otherwise, I would still expect the market to stay on its current track of steady improvement.